IRS W-4 Form Guide

Understanding the IRS W-4 Form: A Comprehensive Guide

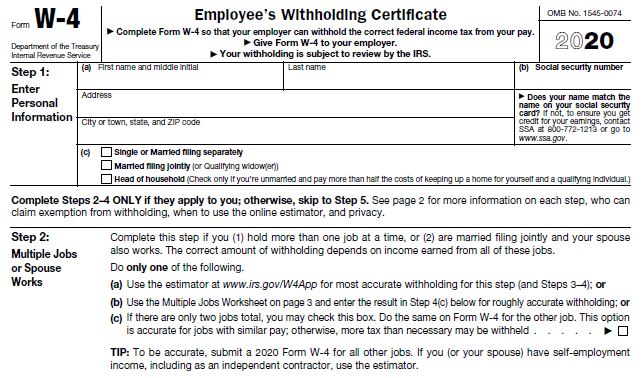

Form W-4 “Employee’s Withholding Certificate” is a document used by employees in the United States that determines how much federal tax should be withheld from their wages. Form W-4 is completed when starting a new job, but can also be updated at any time as an employee’s financial situation changes.

Here are some key information about Form W-4:

- Purpose of Form: W-4 allows an employer to accurately calculate how much federal income tax should be withheld from an employee’s wages.

- Personal Information: The form asks for basic information such as name, address, marital status and Social Security number.

- Deductions and Credits: An employee can declare various deductions and credits that affect the amount of income tax that will be withheld from his or her salary.

- Life Changes: The form should be updated in the event of life changes such as marriage, divorce, birth of a child or changes in income.

- Tax Optimization: Completing Form W-4 correctly can help employees avoid overwithholding, which in turn can increase their net paychecks. However, withholding too little may result in you having to pay extra tax when you file your annual tax return.

Form W-4 is a key tool in managing personal finances, helping employees tailor their tax withholdings to suit their individual needs and circumstances.

How to Fill Out the W-4 Form Correctly: Tips and Tricks

If you’ve just started a new job, and you’re wondering how to fill out the W4 Form, here’s how to go about it. IRS Form W4 controls how much withholding is performed on your paychecks. It doesn’t control your salary. If you try and manipulate your W4 form so that your paycheck is bigger, you’ll just have to pay it back at tax time.

If the way you fill out your W4 form results in having an extra large IRS refund, that’s not good financial planning either because you’re just giving the IRS your money for no reason, and you won’t get it back until you file your federal income tax return. You’re giving the IRS an interest-free loan. It’s your money, so why should you fork it over to the IRS just because you didn’t fill out your W4 form correctly?

An IRS refund is not a gift from the IRS; it’s your money that you should have had in your paycheck all along. If you need to overwithhold so you get a big IRS refund “bonus” every year, then you should probably take a financial planning class or talk to someone who can set you straight. You are losing money by doing this!

Are You Really Head of the household?

Head of household means you pay more than half the bills in a house. For roommates, claiming head of household is not really what the IRS had in mind. However, if you paid more than half the cost of keeping up a house (rent, utilities, food eaten at home, etc) and someone in your household is a qualifying person, go for it.

You get another allowance on the IRS W4 Form. But here’s the tricky little rule: What’s a Qualifying Person? A relative—that’s what it is.

Unless you can claim someone in your household is a relative, no dice on claiming an allowance on Line E as Head of Household. Let’s say your cousin and you share an apartment. Your cousin is out of work, so you pay most of the bills. If he lived with you for more than half the year under these circumstances, yup, you are Head of Household.

Lying About the Future On the W4 Form

Some lines on the Personal Allowances Worksheet ask you to think about your future. For example, if you have a lot of child care expenses and you plan to claim a tax credit for these expenses, the W4 asks you to Enter one on line F. Well of course, you could always say yes, I plan on claiming the child care expenses tax credit, even if inside, deep down, you know it’s never going to happen. Another way to scam the IRS. But really, it’s a terrible idea, since it will lead to being sued by the IRS.

You could also say that you think you won’t be making over $65,000 this year, even though you know that to be a lie. This would allow you to enter “2″ (a double!) on line G for each child you claim you have. Now, if you lie about your children too, you could really rack up some allowances here. And of course, let me remind you that this is a terrible plan since you’ll have to pay it all back when you file your taxes, unless you want to live outside the law for the rest of your life. Oh, and if you plan on collecting Social Security, Medicare, or any public social service like that in the future when you’re old and need money, forget about it! You can’t cheat the IRS, then turn around and ask for help, because that would make you a total scumbag hypocrite loser.*

*Turns out that’s wrong: Social Security and Medicare are not affected by any of the stuff in this article. Your donations to both are based on your base salary, before taxes, exemption, etc. In the case of SS, what you get out is based on what you have put in over your best 35 years. In the case of Medicare, everybody gets the same coverage after qualifying. For most people, the qualifications are 65 yo and qualified for SS (40 credits – you get 1 credit per quarter of paying in to SS).

The W 4 Form Personal allowances Worksheet

The more allowances you enter, the less money is taken out of your paychecks. Everybody gets one on line A unless they are claimed as dependents. For college students and other young adults, check with your family and see whether they are claiming you as a dependent. They might be, since this brings great tax advantages for them.

The more kids you have, the less withholding is performed on your paychecks. There are scammers out there who put down on the W4 (line D) that they have tons of kids. This results in hardly any money being taken out of their paychecks. This is a bad idea for several reasons, including that it’s lying to the IRS and therefore considered tax fraud. But also, when you go to file your income tax return, you’ll owe the IRS a TON of money. Of course, if you don’t file your taxes, then you have nothing to worry about! (Again, not a very good idea, for SO many reasons).

Claiming Exemption From Withholding

Finally, on the actual W4 Form, on line 7, you can just say you shouldn’t have any withholding at all because you are so darn poor, and you were so darn poor last year as well.

By the way notice on the next part under Part &, it says “Under penalties of perjury…”

You have to sign your name, and this is supposed to verify that everything you put on the W4 Form is the truth. If you lied, it’s perjury…don’t want to really mess with that, do you?

For a complete look at the IRS W4 Form, go to the IRS website, and you can see a blank copy, complete with W4 Instructions.

Maximizing Your Paycheck: The Importance of the W-4 Form

Form W-4 is available to employees in the United States, which allows you to safely manage the amount of federal tax withheld from your fees. Correct use of this application affects the amount of the final effect.

When you fill out Form W-4, you provide your employer with information that allows them to calculate exactly how much tax should be withheld from your paycheck.

Filling out Form W-4 accurately will help you avoid a situation in which you are liable for additional tax payments when filing your annual tax return. Thanks to this, you can better manage your finances and avoid unpleasant surprises.

By maximizing your net paycheck by properly completing your W-4 form, you gain more control over your daily finances. A higher net payout means you have more funds available to use immediately for everyday expenses, savings, or investments.

Form W-4 allows you to flexibly adjust your tax withholdings to reflect life changes, such as marriage, the birth of a child, or changes in income. Updating your form in response to these changes will help you maintain the correct level of tax withholding, which will affect your net payout.

With a properly completed W-4 form, the risk of receiving large tax refunds is reduced. While the returns may seem attractive, they actually mean that you have lent money to the government interest-free for an entire year. A better approach is to adjust your withholdings so that you keep this money throughout the year and use it according to your needs.

Common Mistakes to Avoid on Your IRS W-4 Form

Completing Form W-4 may seem complicated, but avoiding common mistakes is key and completing the form has been accepted. Here are some of the most common mistakes people make when filling out Form W-4:

1. Not updating the form if there have been any changes:

Error: Failure to update Form W-4 after significant changes in living status, such as marriage, divorce, birth of a child, job change, or change in income.

Avoid: Review and update your W-4 form regularly to reflect your current living and financial situation.

2. Inappropriate number of dependents

Mistake: Declaring the wrong number of dependents leads to too much or too little tax withholding.

Avoid: Accurately determine the number of dependents, including children and other dependents, to accurately calculate your deductions.

3. No Additional Withholding for Multiple Sources of Income

Error: Failure to declare additional withholding when you have more than one source of income.

Avoid: If you have more than one source of income, use the appropriate section on Form W-4 to declare additional withholding to avoid underpaying tax.

4. Not taking into account Additional Income and Credits

Error: Omission of additional income (e.g. from investments) or tax credits to which you are entitled.

Avoid: Carefully analyze your income and include any additional income and potential credits and tax deductions on your W-4.

5. Mathematical Errors and Typos

Error: Making math or typo errors when filling out a form.

Avoid: Carefully check all calculations and data entered on the form to ensure they are correct.

6. Incorrect Civil Status

Error: Incorrect declaration of marital status (e.g. selecting “Single” instead of “Married”), which affects the final result.

Avoid: Choose the appropriate marital status that best reflects your situation to ensure the correct result.

7. Failure to Obtain Help for Complicated Tax Situations

Mistake: Trying to complete Form W-4 on your own if you have a complicated tax situation without consulting a professional.

Avoid: If your tax situation is complicated, consult a tax professional to make sure Form W-4 is completed correctly.

8. No W-4 Revision After Changes in Tax Law

Mistake: Failure to review and update Form W-4 after tax law changes.

Avoid: Stay on top of changes in tax law and update your W-4 form to reflect new regulations.

9. Failure to submit a New Form W-4 when you change your state of residence

Error: Failure to file a new Form W-4 after moving to a state with different tax laws.

Avoid: If you’re moving to another state, check your local tax laws and update your W-4 form if necessary.

W-4 Form 2024: Key Changes and What You Need to Know

Form W-4 for 2024 includes several important changes. Here are the key changes compared to the previous version:

1. The form is more simplified.

2. Tax deductions and fees updated.

3. New guidelines for declaring dependent persons have been introduced.

4. Instructions for employees with more than one source of income have been updated.

5. Simplified IRS Calculator

6. Additional options have been introduced in the marital status field.

7. Guidelines for employees employed on short-term contracts have been added.

8. New Instructions for Pensioners